Out of the goodness of their heart, many give charitable donations.

If the organization you are donating to is tax-exempt, you maybe able to deduct your donation. To find out information about an organization’s federal tax status and filings, the IRS has developed a tool that allows you to search for charities.

You can CLICK HERE to view the tool on the IRS website itself

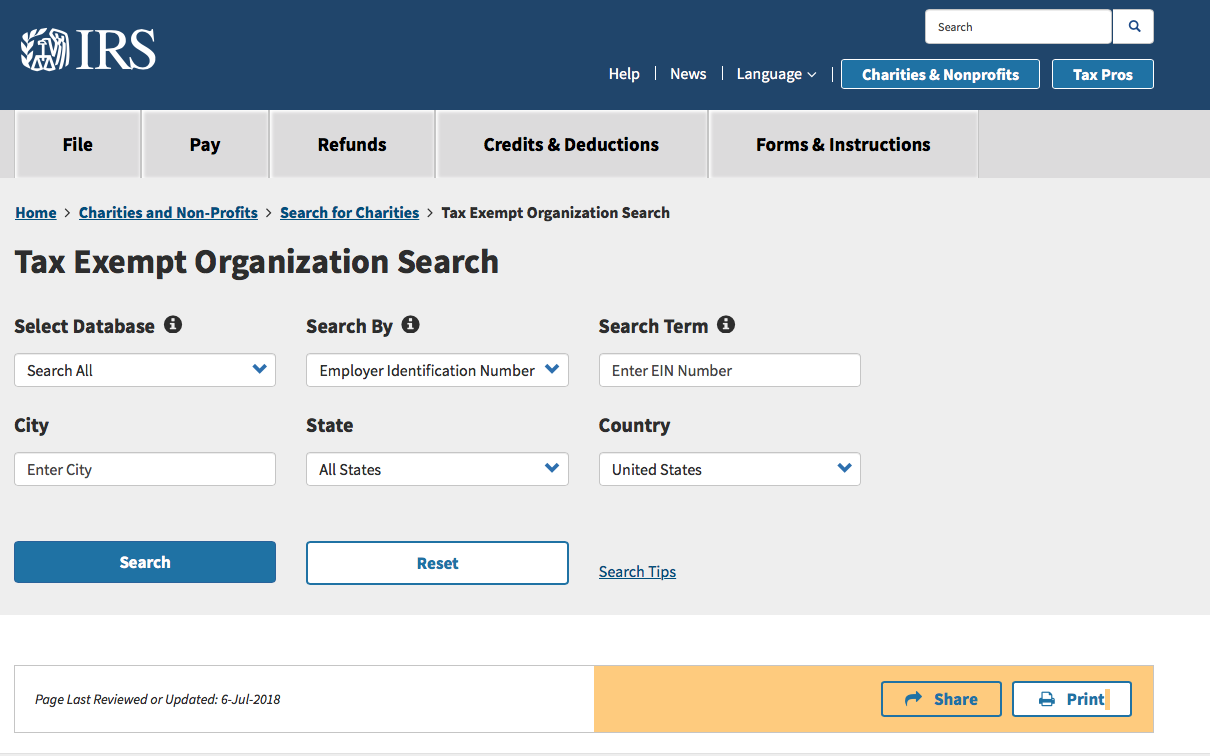

Below is a step-by-step of how to use this tool:

Step One: When you click the link above, you will be taken to the IRS website. The search tool is on the website, near the bottom. Click the blue button with the words “Tax Exempt Organization Search”.

Step Two: You will now be taken to the below page. Although the information may seem overwhelming, we will show you how to research the organization with just the name.

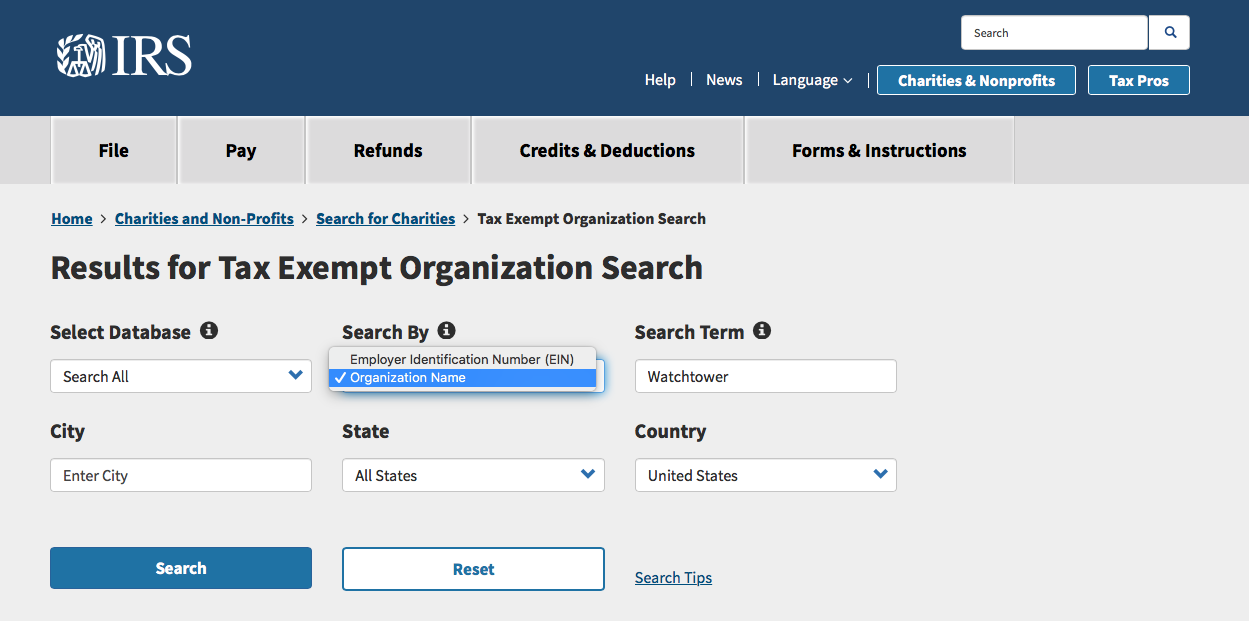

Step Three: Switch the “Search By” from “Employer Identification Number” to “Organization Name” in the drop down menu. Then, in the search bar to the right, enter the organization’s name. In this example, we have selected the organization “Watchtower”.

Step Four: Click the blue “Search” button at the bottom of the page. You then will be taken to a list of organizations that contain that keyword. Select the organization that you are wanting to donate to.

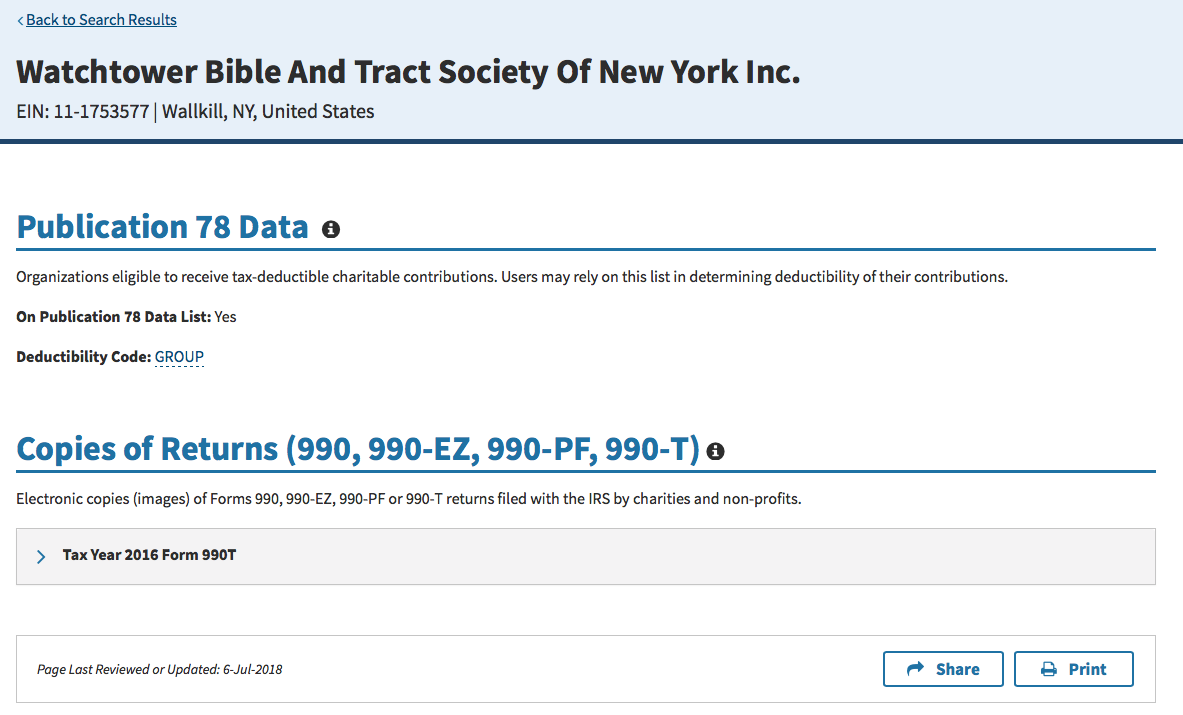

Step Five: You can then click the ‘Tax Year” dropdown menu to view important information of the company and to find out if it is tax-exempt.

By using this tool, you can determine if you can deduct your charitable donations. If you have any questions, the #GoldenGirls are here to help.