Self-em.ployed; adjective: Working for oneself as a freelancer or the owner of a business rather than for an employer.

Synonyms: freelance, independent, casual.

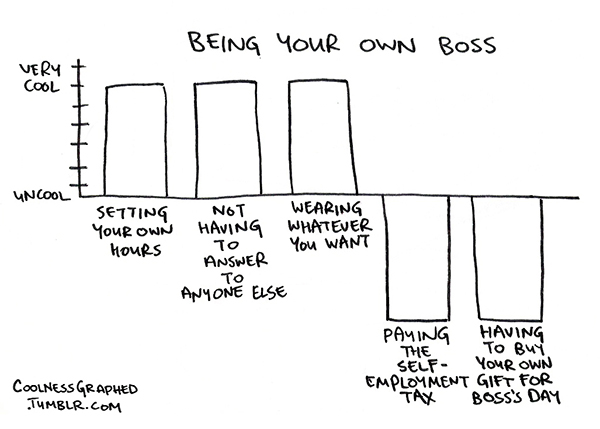

There are many benefits to being independent and free. Right about now, however, when the 1099s start rolling in you may start to feel a little less independent and free when you start to get an idea of what you will be paying in income taxes. If you have been making your estimated taxes, you likely feel less anxious.

Paying estimated taxes is not only of benefit, but also a requirement for most self-employed individuals. To avoid the anxiety next year, start paying estimated taxes this year. Payment due dates go as follows:

April 15th

June 15th

September 15th

January 15th of the next year

Another tax you should be paying is self-employment tax. Self-employment tax is not you being penalized for going out on your own. Self-employment tax consists of social security and medicare taxes for individuals working for themselves. Receiving social security benefits when you retired is contingent on you paying this tax.

Thinking about taxes is not the fun part of being a business owner; but it is necessary. This is not the area to let go, however. If you feel overwhelmed trying to care for this aspect of your business, we are happy to help. Taking care of your business now is taking care of yourself in the future.

40 years from now you will be so happy you handled your business, and you will have the satisfaction of doing it while setting your own hours, wearing whatever you wanted and not answering to anyone else (well…except the IRS).