2024 Mileage Updates

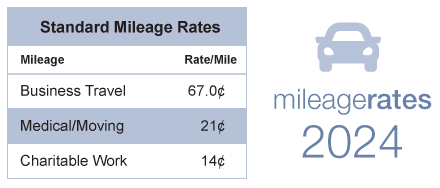

Mileage rates for travel are now set for 2024. The standard business mileage rate increases by 1.5 cents to 67 cents per mile. The medical and moving mileage rates are now 21 cents per mile. Charitable mileage rates remain unchanged at 14 cents per mile.

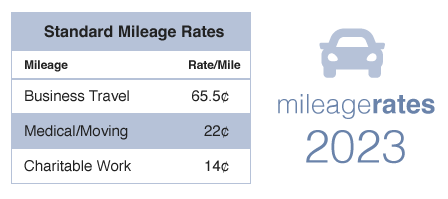

2023 Mileage Rates:

2024 Mileage Rates:

Notes

Remember to properly document your mileage to receive full credit for your miles driven.

If you want to know more about how to make sure you get the full credit for business mileage, click here to schedule an appointment with one of Gold Standard's seasoned tax accountants.

Contact us:

[email protected] | CA (760) 888-6247 | NY (845) 237-4060

Want to work with us? Click here for Career Opportunities with Gold Standard Tax

Copyright © Gold Standard Tax & Accounting. All Rights Reserved.